I’m as struck by this recent finding as you are…

It’s not that they are close, we’ve talked a lot about it, it’s how Chinese frame it and celebrate it… It’s like seeing your world through the eyes of an alien civilization.

China’s fascination with the Rothschild family

CGN, 2018-02-28

The seventh generation of the Rothschild banking dynasty will take over the centuries-old bank this summer, according to the Financial Times.

Controversy and conspiracy theories over the family’s supposed control of wealth have long existed in the West, but in recent decades more and more Chinese economists and budding entrepreneurs have closely studied the Rothschilds.

At the same time, members of the Rothschild family have looked to a rising China for new business opportunities.

The next generation

According to the Financial Times, Alexandre de Rothschild will take over as chairman of Rothschild Bank from his father David de Rothschild this summer, with the 37-year-old expected to lead the way in diversifying the group beyond “its core French and British advisory business.”

Outgoing Chairman David de Rothschild. /VCG Photo

Alexandre de Rothschild joined the family business a decade ago, overseeing a period when the bank has looked to push beyond Europe in terms of investment strategy.

In fact, the Rothschild family came to China as long ago as the 1830s, when it set up a small gold and silver trading business in Shanghai. In 1953, four years after the founding of New China, Rothschild was one of the first major Western banks to establish relations with the country.

A history of investments in China

In 2008 La Compagnie Financiere Edmond de Rothschild (LCFR), the bank’s French branch, was on the verge of securing 2.3 billion yuan (336 million US dollars) worth of investment from the Bank of China. That deal however fell through after failing to get approval from the Chinese government.

In 2011, UK-based Rothschild subsidiary RIT Partners set up one of the first private equity funds in China to raise renminbi in the country and invest it overseas, with a target of amassing 750 million US dollars within its first year.

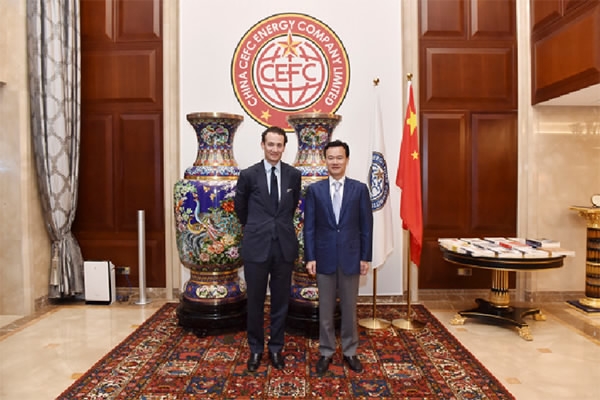

Alexandre de Rothschild (L) with CEFC China Energy Chairman Ye Jianming in Shanghai, May 2017. /China Daily Photo

Last year, Alexandre de Rothschild met with Ye Jianming, chairman of CEFC China Energy, with both sides agreeing to strengthen cooperation in sectors including energy, financial services, aviation, infrastructure construction, food and high-end property management.

China’s fascination with the Rothschilds

Beyond its growing financial presence in the country, the past decade has seen growing cultural awareness in China of the Rothschild family.

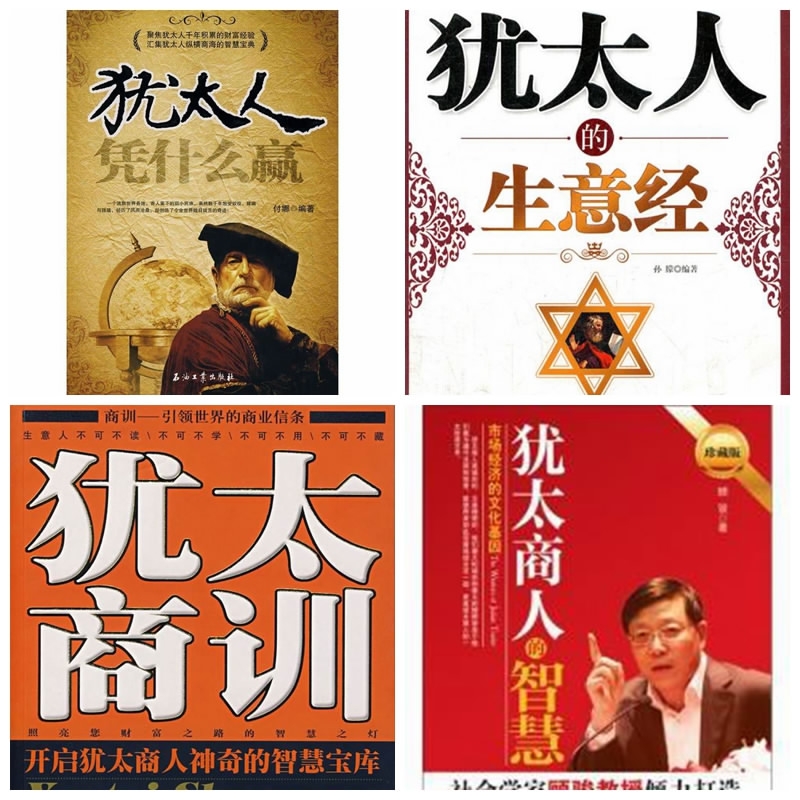

Several bestselling but controversial books have seen a wave of interest in Jewish business practices, particularly among wealthy entrepreneurs and investors looking to establish their own family legacies.

Published in 2007, Song Hongbing’s Currency Wars was an instant success in China, with publisher CITIC claiming there were some 600,000 copies in circulation within months of it being released.

In the book, Song, who studied and lived in the US from 1994 and worked as an IT consultant, claims the Rothschild family control five trillion US dollars’ worth of global wealth.

Song’s work was widely criticized in the West as an “economic novel,” and lambasted for promoting anti-Semitic conspiracy theories.

The Financial Times reported that Currency Wars was widely read by Chinese company heads and government officials, with Song himself saying “I never imagined it could be so hot and that top leaders would be reading it.” He insisted that the book was not anti-Semitic.

Jon Benjamin, then the chief executive of the Board of Deputies of British Jews, told the Financial Times he was concerned by the book, and was worried that the Rothschild conspiracy theory was gaining traction “in the world’s most important emerging economy,” despite China having “little or no concurrent culture of anti-Semitism.”

Song Hongbing, who currently has almost two million followers on Sina Weibo, has gone on to publish five books in his Currency Wars series, and since 2007 more and more books on the Rothschilds and more generally on so-called Jewish business practices have been published.

Chinese books on Jewish business practices, from top left, clockwise: How do Jewish People win?; Jewish Business Bible; Jewish Businessmen’s Wisdom; Jewish Business Teachings. /Images from China Daily, Douban

Titles such as “The Legend of Jewish Wealth,” “Jewish Family Education” and “The Illustrated Jewish Wisdom Book” can all be found in the business sections of bookstores across China.

Han Bing, who wrote business self-help guide “Crack the Talmud,” told Newsweek in 2010 that Jews and Chinese shared historic and cultural similarities. When pressed on whether his book was promoting stereotypes, Han admitted that he had never met a Jewish person in his life.

Falling for fake wine and frauds

The Rothschild name is also synonymous with Chateau Lafite in China, one of the most popular wine labels for the country’s wealthiest people.

Selling for as much as 10,000 US dollars per bottle, Xinhua reported in 2011 that the majority of Lafite sold in China could be fake, as sales figures reported in just Zhejiang Province were exceeding official global production figures.

Beyond fake bottles of Rothschild wine, a man named Oliver Rothschild who pretended to be part of the banking dynasty infamously fooled Tsinghua University in 2016.

The British man was given the red carpet treatment by the university, with Dean Qiu Yong calling him “one of the successors of the Rothschild family,” and claiming he was a former head of UNICEF.

The real Rothschild family released a statement saying Oliver Rothschild was not connected to the family in any way, after reports that he had traveled around China for several years giving speeches under the guise of being part of the banking family.

The “fake Rothschild” Oliver Rothschild in 2014. /VCG Photo

After Tsinghua admitted it had fallen for the fraud, The Global Times said the story showed China’s “longing for international endorsement, especially from the developed world, as an indicator of being something.”

Also watch:

The Rothschilds: Top investors in Asian coal, Chinese pollution and subversive climate policies

+++

CHINESE COMMUNISM IS AS JEWISH AS ITS RUSSIAN COUSIN (YOUTUBE BAN WINNER)

To be continued?

Our work and existence, as media and people, is funded solely by our most generous supporters. But we’re not really covering our costs so far, and we’re in dire needs to upgrade our equipment, especially for video production.

Help SILVIEW.media survive and grow, please donate here, anything helps. Thank you!

! Articles can always be subject of later editing as a way of perfecting them

! Articles can always be subject of later editing as a way of perfecting them

SEE DETAILS / ORDER